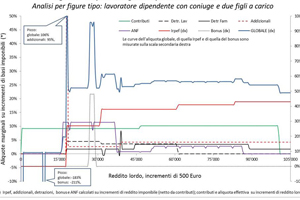

The effective tax rates jungle. Effective marginal and average tax rates in the 2017 Italian tax-benefit system for individuals and households

The Italian tax-benefit system generates a broad range of effective marginal tax rates, with positive and negative values, determining, in some cases, also a "poverty trap" (that is a marginal tax rate higher than 100 percent). The marginal and average tax rates are also sometimes decreasing with growing taxable income, while at a low level of income we have such high tax rates that a disincentive for labour supply may result. With this evidence, a correction of the Italian tax-benefit system appears desirable both to preserve a more efficient income redistribution as well as labour supply incentives.

Dossier (in English)

Dossier (in English)